Stock portfolio risk calculator

VectorVest gives you ANSWERS not just data. In both cases you are investing in a highly diversified portfolio of shares which is ideal for a long-term financial plan.

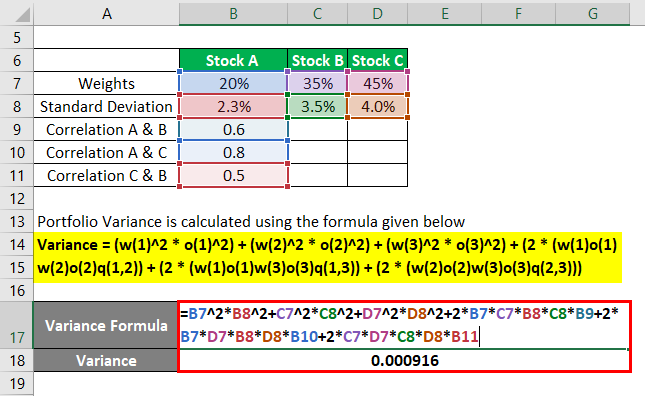

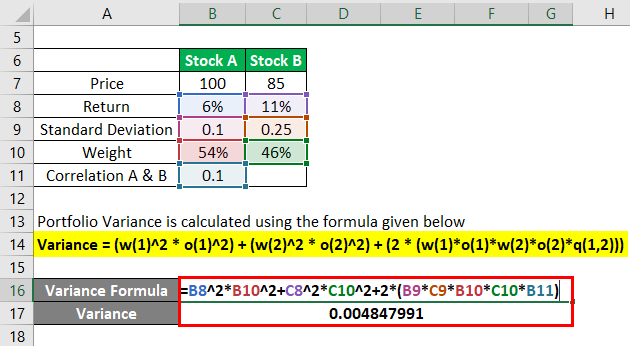

Portfolio Variance Formula How To Calculate Portfolio Variance

Trading with leverage can work against you as well as for you.

. Dividend Calculator by Stock. The formula for a stock turnover ratio can be derived by using the following steps. CMS Prime offers trading on margin.

Assists you in Personal Finance Financial Planning Financial Management Investment Trading Business Insurance Retirement Planning Banking and Financial Services by Tutorial Courses e-learning Definitions Examples Quizzes Books Question and Answers and much more learning by fun and simple ways. 12 Best Stock Portfolio Trackers in 2021. The higher the Gamma the more sensitive an option will be to swings in the price of the underlying stock.

The stop price is one minus the trailing stop TS percentage times the entry price. As managing your risk is the other side of spending. But you can buy a group of them in a stock fund and reduce your riskDividend stock funds are a good selection for almost any kind of stock.

I now manage all my stock investments using Stock Rover Barry D. Each stock has a specific symbolFor example Apple Inc. Various traders invest blindly and do not think about the risk involved with it.

Thus beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Gamma risk refers to one of the Greeks that options traders use to analyze options contracts. Definitions for each Category.

Input the returns of the company and the returns of the market for a period of time. Then compare these against a stock market index such as the SP 500 or the. AP FILE - A screen displays market data at the New York Stock Exchange in New York Wednesday Aug.

This calculator is for illustrative purposes only and is a hypothetical representation of future values and not indicative of the performance of any Questwealth Portfolios customer or model portfolio. Hedge your stock portfolio to reduce market risk. These risks are not related to the.

The equity at risk shows the risk percentage times total investable assets. It is the clients obligation to evaluate the risks of portfolio margin when making investment decisions. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product.

Client should read the Risk Disclosure Document issued by SEBI relevant exchanges and Dos Donts by MCX NCDEX and the. Narratives and expectations are the sources of risk that lead to short term fluctuations in share prices. Carefully read the Portfolio Margin Risk Disclosure Statement Margin Handbook and Margin Disclosure Document for specific disclosures and more details.

As a measure of risk is the calculation of the beta of a portfolio in order to quantity its risk. This usually occurs when the option is close to the money. The number of units shows the amount of shares to invest in.

Gamma measures the volatility of another Greek known as the Delta. Their symbol is AAPL. Apple Inc Balance sheet Explanation.

1 The first tool that Mukherjea who runs PMS firm Marcellus says can help investors mitigate volatility is to increase the investment horizon from 1 year to 3 years as the longer the investment horizon the lower the noise. TrackYourDividends tool can be used as a stock dividend calculator or as a dividend portfolio calculator. In finance the beta β or market beta or beta coefficient is a measure of how an individual asset moves on average when the overall stock market increases or decreases.

Investment goal calculator. Because it gives a measure of how risky the firms stock is with respect to the market. This is the name of the Stock that you desire to select for this calculator.

The SP 500 on the other hand represents 500 large-cap companies listed on the US stock markets. I have been researching and investing in stocks for 20 years. The position value is the number of units times the entry price.

Delta Investment Tracker Sharesight Personal Capital Kubera Stock Rover Webull SigFig Yahoo Finance Ziggma. You may also contact TD Ameritrade at 800-669-3900 for copies. PMS Portfolio Management System Stock Portfolio Equity Portfolio.

Stocks are holding steady in the early going on Wall Street Friday Aug. Personal Capital also has an Investment Checkup. Hedging stocks does come at a cost but can give investors peace of mind.

26 ahead of a widely anticipated speech by the head of the Federal Reserve thats expected to yield more clues on the central banks outlook on the economy inflation and. Use this Beta Calculator to find the beta of a company. When you are looking at individual stocks you can easily find accurate data for each field to get a big picture look at the impact an individual holding will have on your portfolio.

Get Stock Rover Premium Plus Now or Read the In-Depth Stock Rover Review Test. Before deciding to trade you should carefully consider your investment objectives level of experience and risk appetite. Portfolio managers adjust your portfolio to reduce risk while maximizing gains.

Trading FX and CFDs on margin carries a high level of risk and may not be suitable for all investors. For those unaware the FTSE 100 represents the 100 largest companies listed on the London Stock Exchange. While risks can seldom be avoided completely portfolio hedging is one way to protect a portfolio against a potential loss.

Our position sizing calculator has a simple formula thats time-tested. Risk and uncertainty are a given when it comes to financial markets. This represents how much it costs per shareThis is the issued price per share that is constantly being updated on a daily basis.

In the case of an all-equity portfolio that might mean looking at the total number of portfolio components. LOGINTRADE NOWLEARN TO TRADE. Many successful traders tend to be sector experts and seek out lesser known companies called as rising stars.

Our knowledgeable team is ready to help. VectorVest is the only stock analysis and portfolio management system that analyzes ranks and graphs over 18000 stocks each day for value safety and timing and gives a clear buy sell or hold rating on every stock every day. Thats the price-to-earnings ratio of the portfolio as a whole its dividend yield as a whole and the expected growth rate in look-through earnings per share.

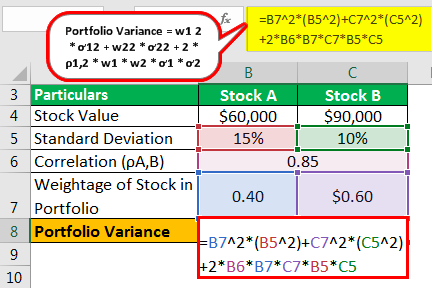

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Portfolio Analysis Calculating Risk And Returns Strategies And More

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

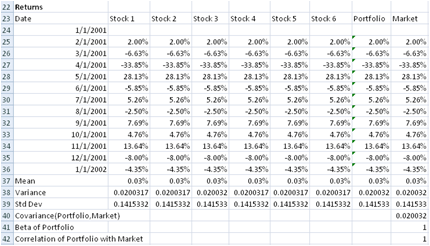

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

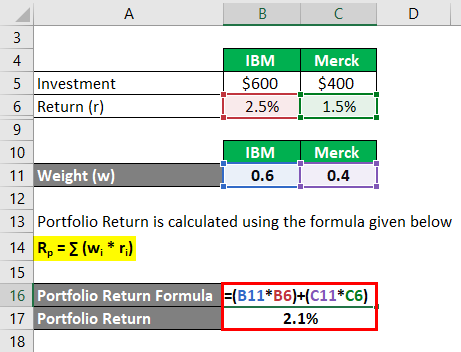

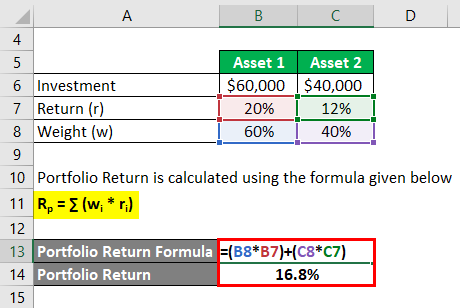

Portfolio Return Formula Calculator Examples With Excel Template

How To Calculate Var Finding Value At Risk In Excel

Portfolio Variance Formula How To Calculate Portfolio Variance

Portfolio Variance Formula How To Calculate Portfolio Variance

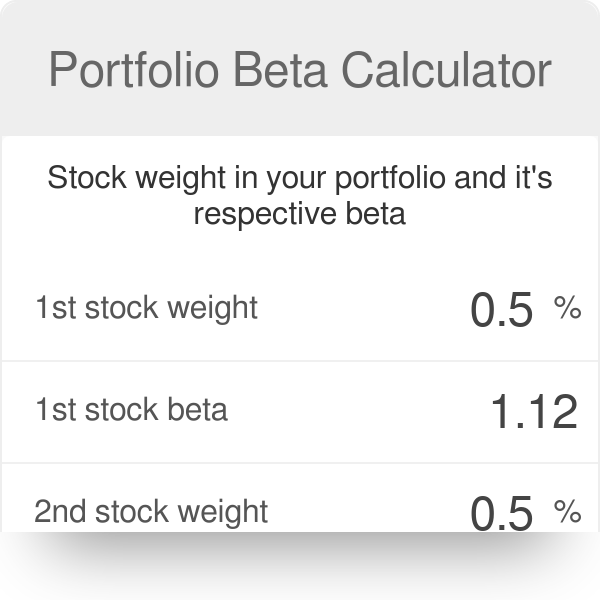

Portfolio Beta Calculator

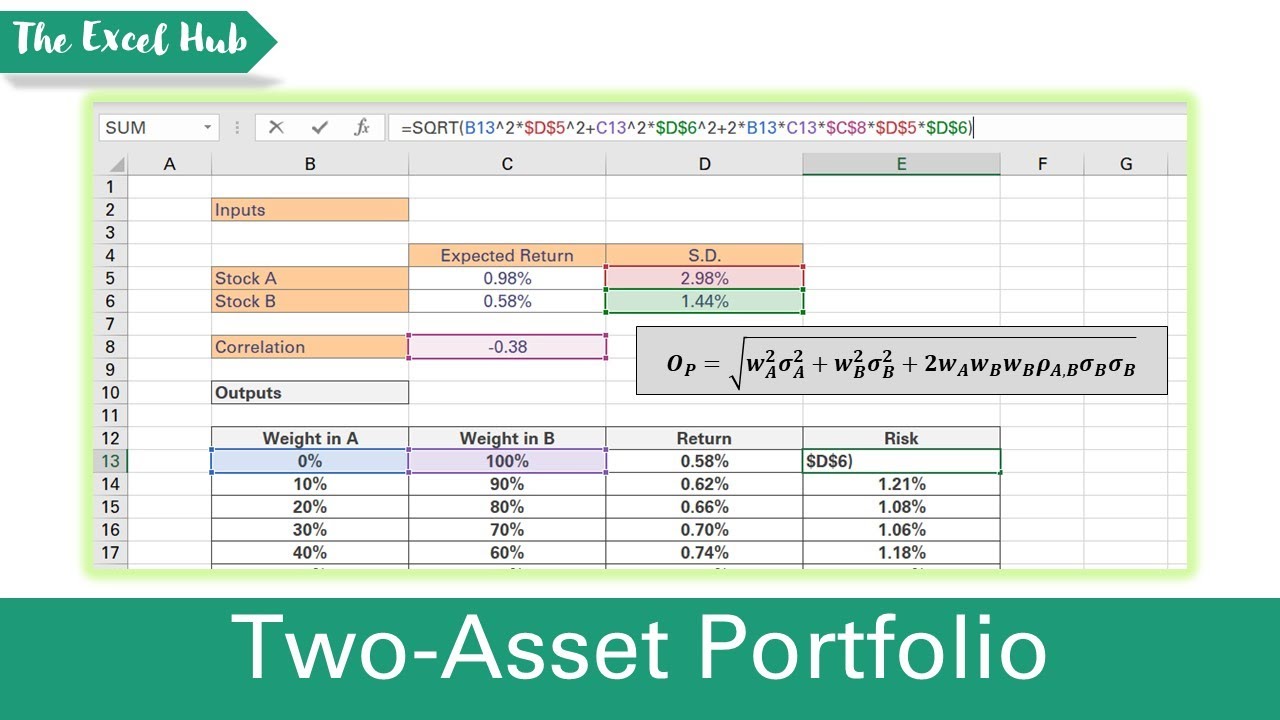

Calculate Risk And Return Of A Two Asset Portfolio In Excel Expected Return And Standard Deviation Youtube

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

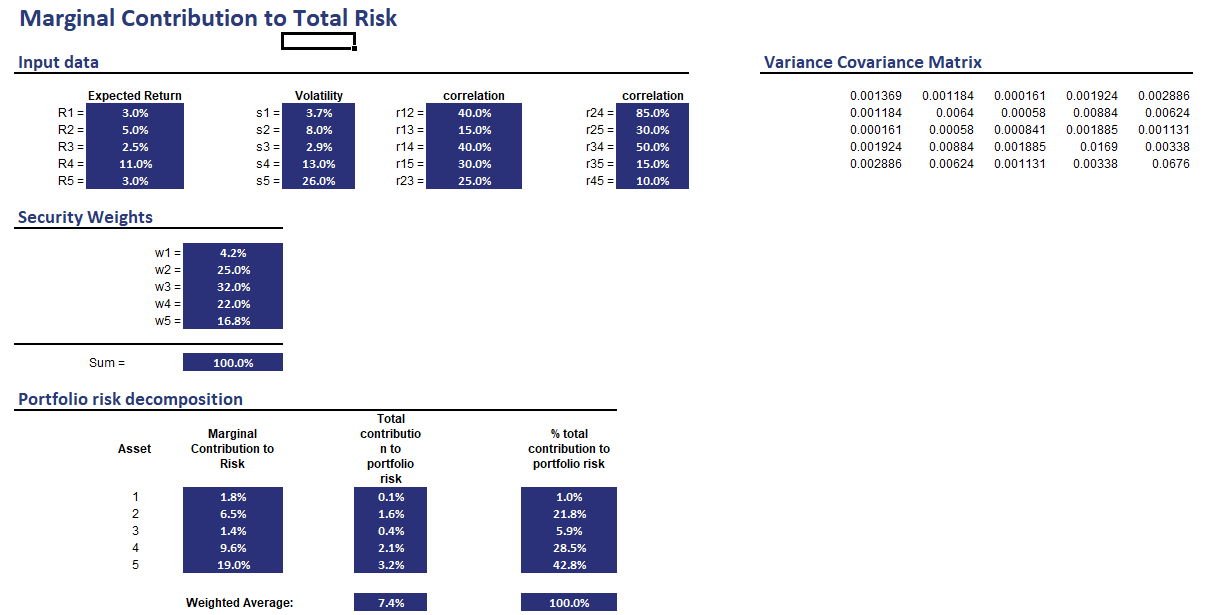

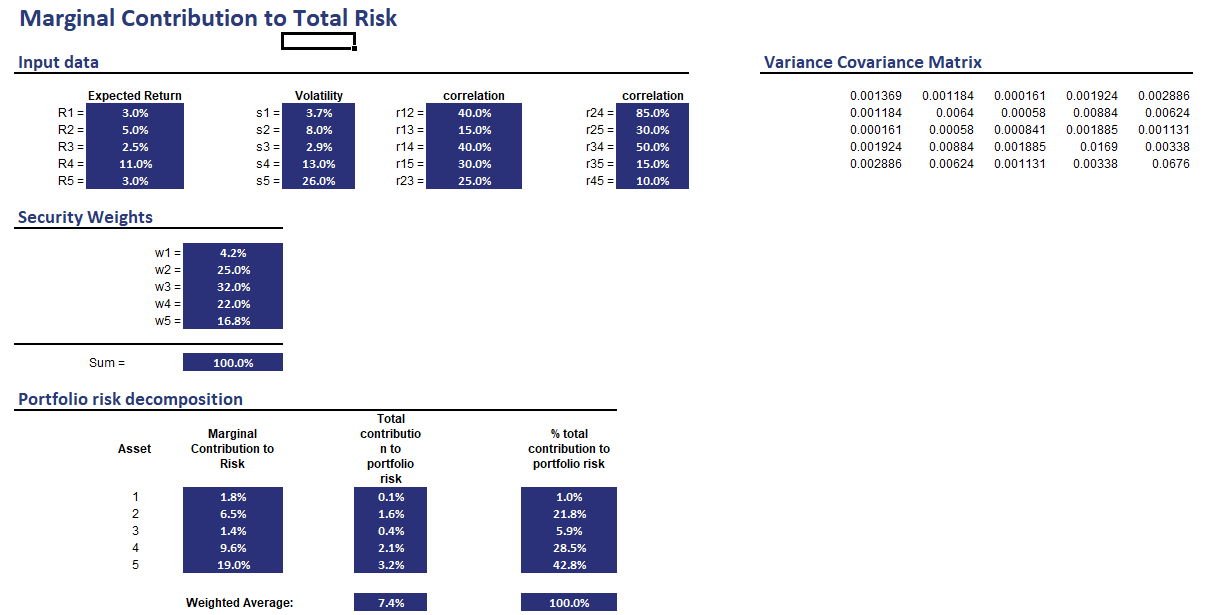

Marginal Contribution To Risk Mctr Implementation In Excel

Portfolio Variance Formula Example How To Calculate Portfolio Variance

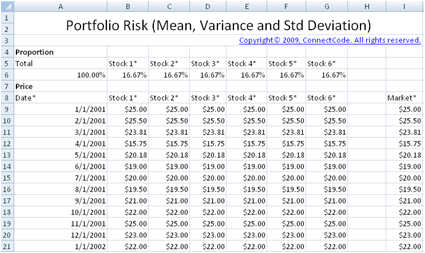

How To Easily Calculate Portfolio Variance For Multiple Securities In Excel Youtube

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

Position Size Calculator Investment U Investment Tools